It's hard to go too long these days without hearing someone hype the benefits of big data. It's to the point where the term is all but a cliché. Hard to believe that's it's still a fairly recent coinage.

"Maybe three years ago?" says Cynthia Burghard research director for accountable care IT strategies at IDC Health Insights, when asked when she first heard the now-ubiquitous term. "It's still relatively new, across all industries. Some industries have used pieces of the big data and analytics technology stack, but not in its entirety."

So much has changed in the past few years when it comes to data and analytics in healthcare – never mind the quantum leap from where we were a decade ago.

"We've come a long way," she says. "We now have technology that can do high-performance computing, that can bring data in from multiple sources – both structured and unstructured. Ten years ago, you were lucky if you could even find data that you could use.

"I worked at a health plan and I wanted to run a very simple report that told me the number of hospital days per thousand members. And it took three weeks for that program to actually run. And then you had to add this, subtract this, divide by three, and then hope for the best. Very crude data. Very cumbersome access. You always had to go through IT to get your data."

Predictive analytics is another big buzzword nowadays, but not too long ago, "it was about reporting facts – and mostly retrospectively." At a payer, it wasn't uncommon to be scrutinizing data that was three to six months old, she says. "It was very hard to make any kind of use for decision-making. By the time you actually got the data, the horse was out of the barn, so to speak."

Two things have driven the belated – and arguably still inadequate – move toward analytic intelligence in healthcare, of course. The technology has advanced, and payment reform has forced the issue.

"We really only started automating healthcare maybe 20 or 25 years ago," says Burghard. "Before that it was manual charts, handwritten claims. Even in the late '80s we had rooms full of claims. Stacked to the ceiling!"

And "it wasn't really until the late 80s, early 90s when the first cost really jumped up and people said, 'Oh, we can't sustain 12 and 15 percent premium increases every year.' The industry realized it had to do something about managing cost and quality that the industry turned its attention to analytics. It hadn't really be necessary because there wasn't really any cost pressure."

Still, it's really only been in the past half-decade or so, since HITECH, the Affordable Care Act and assorted other payment reform initiatives, that use of analytics has started to gain steam.

"The new reimbursement models, the only way they're going to be successful is if they have good data: what their health conditions are, what their family situation is, and then a whole range of information about the delivery system, and where's the most cost-effective, high-quality physician or hospital that that person should be going to," says Burghard.

If deployment of analytics technology has been halting in the past, it's undoubtedly on the rise. Frost & Sullivan projects the usage of advanced health data analytics solutions in hospitals will increase to 50 percent adoption by 2016.

"Hospitals will increasingly invest in advanced data analytics solutions to monitor end-to-end care delivery across a variety of settings," said Frost & Sullivan analyst Nancy Fabozzi in a statement. "Due to growing competitive pressures, hospitals need to provide comprehensive reporting on performance and quality measures to a variety of stakeholders. Advanced analytics capabilities are absolutely critical for survival – there is no way to avoid it."

The trends are clear. "Virtually all the surveys we do in healthcare, both payer and provider, analytics really is top of mind in terms of investments," says Burghard.

IDC Health Insights' has a Big Data and Analytics Maturity Model, which helps organizations make the most of their data strategies and understand the best ways to apply their people, technology, and data.

HIMSS Analytics has also recently launched its own analytics benchmarking service, joining forces with the International Institute for Analytics this past November to launch the DELTA Powered Analytics Assessment, which helps an organization gauge the strength of its analytics program and decide where next to focus resources to improve it.

"New healthcare delivery models, such as accountable care and patient-centered medical homes, require the use of analytics to better understand patient populations, medication adherence and other types of patient-centered statistics and activities," said James Gaston, senior director of clinical and business intelligence at HIMSS Analytics.

"The DELTA Powered Analytics Assessment allows healthcare organizations to better understand their analytics capabilities, and to plot a course to derive value from and advance them over time," he said.

If healthcare analytics has made undeniable progress in 10 years, it hasn't been uniform across the industry.

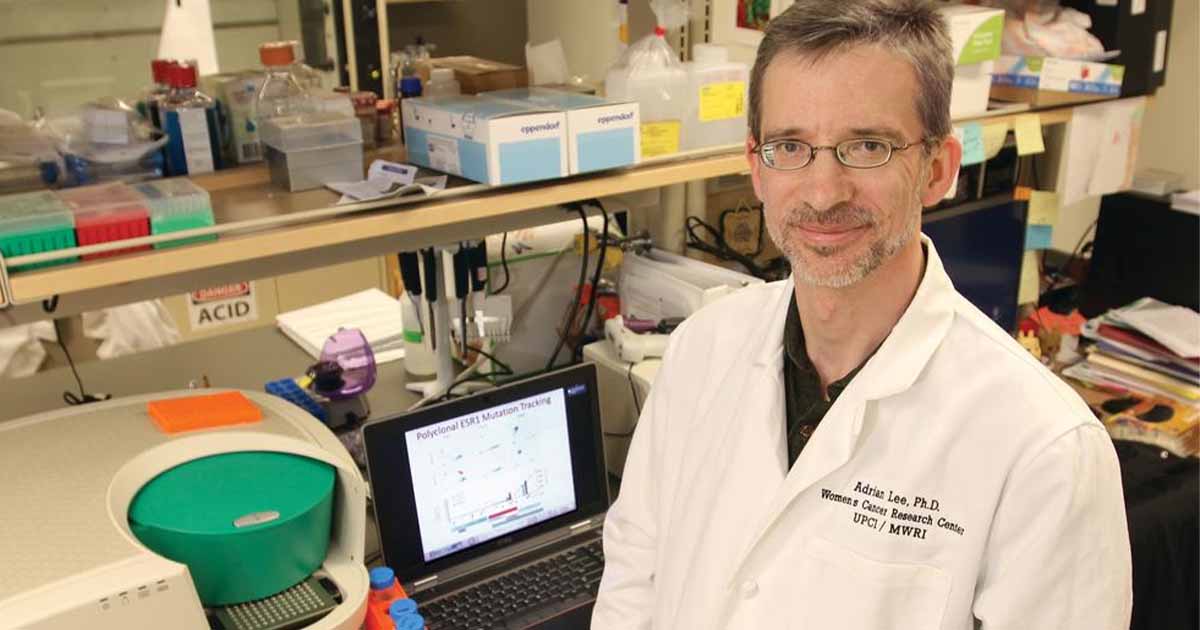

"You have to look at the market as segments," says Burghard. "At the top of the market, organizations such as UPMC and Mayo and Geisinger are investing hundreds of millions of dollars in analytics capabilities. Because they get the value of it.

"Then you have health plans that have typically invested more aggressively than providers have doing really well: Aetna or Cigna or United. They've got both the technology and the staff to really work the data."

Below that top tier, capabilities "start getting pretty quickly into packaged applications," she says. "There's a class of vendors in the industry that sell healthcare business intelligence apps, and that's kind of the norm as far as investment. And then at the bottom of the market you've got organizations working with Excel."

No question, "one of the barriers to big data and analytics in healthcare is just the pure cost of it," says Burghard.

But in the near future she sees a more affordable approach that could help further spur uptake of the technology: the proliferation of analytics-as-a-service.

One might imagine that after, say, UPMC has made all those big investments in analytic technology, "they may be willing to host data from another delivery system and support them analytically," she says. A smaller organization that doesn't have the ability to invest in the technology, or the wherewithal to recruit tech-savvy folks such as informaticists and biostatisticians, could find that very useful.

So, some big progress on big data in the past decade. And more yet to come. What could be happening 10 years from now?

"I think there will be, if it continues on this trajectory, access to multiple sources of data," says Burghard. "You'll see an industry that is much more industrialized, where decisions really are made based on data."

[See also: Big data driving analytics investments]